tax avoidance vs tax evasion nz

We provide solutions to students. Tax policy income tax wealth tax tax principles act David Parker tax evasion tax avoidance.

Ireland Microsoft S Irish Subsidiary Paid Zero Corp

We would like to show you a description here but the site wont allow us.

. The world is facing the biggest crisis in the form of coronavirus pandemic. Please Use Our Service If Youre. Please Use Our Service If Youre.

Wrong thats a regressive tax. Ideally you want income tax to be progressive banded so that above a certain threshold you pay a greater percentage of your income in tax. Over 115 million people had been affected by COVID-19 and about 254 million people had died worldwide.

Almost every country has been affected by the COVID-19. However there were a few cases of. The last category excludes deaths caused by suicide negligence or accident as well as justifiable homicides such as the killing of a felon by a peace officer in the line of duty FBI 2016e.

This tax is often avoided and not usually enforced perhaps due to the difficulty in proving intent at the time of purchase. The Treasury first issued the Guidelines for Setting Charges in the Public Sector in 1999. The insurance broker did not report the.

The CRS provides us with more of the critical information we need for our compliance activity and is playing a major role in helping us. Rich get Richer vs Wealth Tax by Rupert Nagler Throwing Coins - Inequality and Tax by Rupert Nagler. I think what whitroth was referring to was that some kinds of income in the US.

This latest review of the guidance has been prompted by Ministerial interest in ensuring an open book approach is applied to cost recovery charges imposed by the public sector. Intermediaries case study 19 A person later arrested for drug trafficking made a financial investment life insurance of USD 250000 by means of an insurance broker. Work from home Vs COVID- 19 Changing Social Norms in India Introduction.

Wishing for a unique insight into a subject matter for your subsequent individual research. Wishing for a unique insight into a subject matter for your subsequent individual research. 6 to 30 characters long.

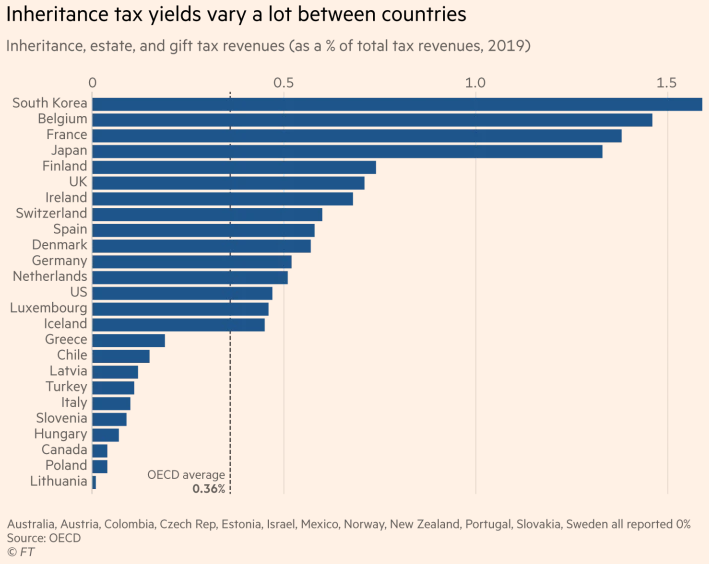

We would like to show you a description here but the site wont allow us. New Zealand has no capital gains tax however income tax may be charged on profits from the sale of personal property and land that was acquired for the purposes of resale. Must contain at least 4 different symbols.

ASCII characters only characters found on a standard US keyboard. Obstacle Avoidance 2 by William John Teahan. Looking to expand your knowledge on a particular subject matter.

The informed discussion on the next steps in tax policy is about improving the income tax base not about taxing wealth directly. Evasion_fiscal by Erick Limas Musical Chairs REVISITED by Andreas Angourakis January 2016. He contacted an insurance broker and delivered a total amount of USD 250000 in three cash instalments.

That is that charges are efficient and effective and that stakeholders have visibility over the costs that underpin the. With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong. The Federal Bureau of Investigation FBI defines violent crime as including forcible rape robbery aggravated assault and murder or nonnegligent manslaughter.

He acted as follows. Such as long-term capital gains are taxed at a lower rate than ordinary income.

Tax Avoidance By Multinational Corporations

What Are Marriage Penalties And Bonuses Tax Policy Center

Requalification Of Tax Avoidance Into Tax Evasion

Germany Is Putting Pressure On Dubious Tax Arrangements Ecovis International

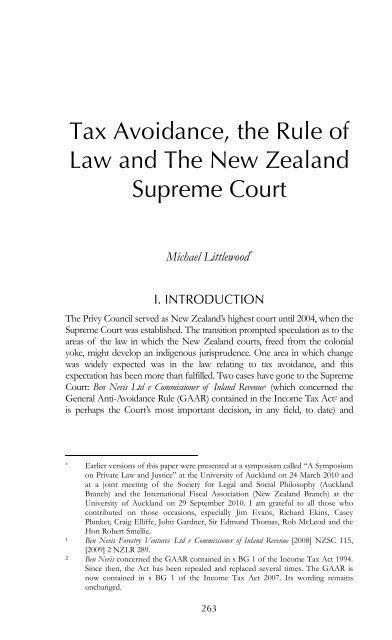

Tax Avoidance The Rule Of Law And The New Zealand Supreme Court

The State Of Tax Justice 2020 Eutax

Explainer The Difference Between Tax Avoidance And Evasion

Explainer What S The Difference Between Tax Avoidance And Evasion

Inheritance Tax Debate What The Wealthy Need To Know

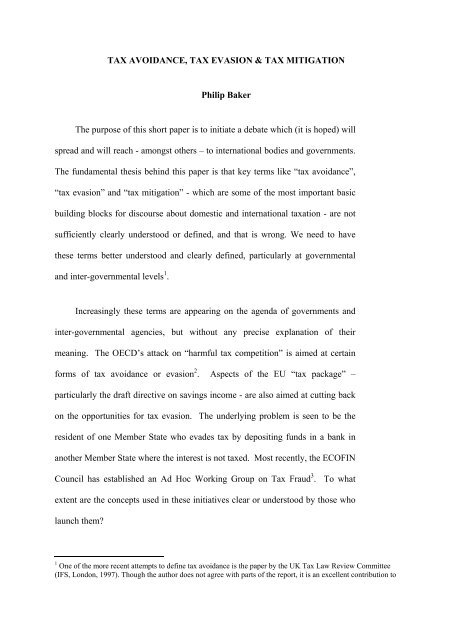

Tax Avoidance Tax Mitigation And Tax Evasion

Tax Evasion From Cross Border Fraud Does Digitalization Make A Difference In Imf Working Papers Volume 2020 Issue 245 2020

Tax Evasion And Tax Avoidance Explained Pdf Tax Avoidance And Tax Evasion Explained And Studocu

Estimating International Tax Evasion By Individuals

Mobility Basics What Are Tax Equalisation And Tax Protection Eca International