south carolina estate tax exemption 2021

SC Tax Structure State Deductions and Exemptions South Carolinas other major state deductions contribute to low tax burden June 2021 4 In addition to the standard. The County Assessor however automatically will apply rollback taxes.

Compare your take home after tax and estimate.

. The District of Columbia moved in the. 1 The first fifty seventy-five thousand dollars of the fair market value of the dwelling place of a person is exempt from county municipal school and special assessment. The size of the estate tax exemption meant.

The estate tax exclusion is 4000000 as of 2021 after the district chose to lower it from 5762400 in 2020. If they are married the spouse may be able to leave everything to each other without paying any. Effective for property tax years beginning after 2020 and to the extent not already exempt pursuant to Section 12-37-250 and this section fifty thousand dollars of any.

Inheritance and Estate Tax and Inheritance and Estate Tax Exemption. The Homestead Exemption is a complete exemption of taxes on the first 50000 in Fair Market Value of your Legal Residence for homeowners over age 65 totally and permanently disabled. Currently south carolina does not impose an estate tax but other states do.

South Carolina has a capital gains tax on profits from real estate sales. Starting in 2022 the exclusion amount will increase annually based. South carolina estate tax exemption 2021 Tuesday April 26 2022 1 The first fifty one hundred thousand dollars of the fair market value of the dwelling place of a person is.

In effect husband and wife are treated as one. The County Assessor however automatically will apply rollback taxes. A married couple is exempt from paying estate taxes if they do not have children.

South Carolina has no estate tax for decedents dying on or after January 1 2005. The applicable South Carolina county will not prorate rollback taxes between purchasers and sellers. South Carolina Code Section 12-43-220 requires that any time a property changes from receiving the benefit of an agricultural use special assessment ratio property tax.

The applicable South Carolina county will not prorate rollback taxes between purchasers and sellers. 2021 South Carolina Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. The estate tax exemption is adjusted for inflation every year.

According to the South Carolina Department of Revenue the Homestead Exemption relieves you from taxation on the first 50000 in fair market value of your owned. South carolina estate tax exemption 2021 Tuesday April 26 2022 Edit. 2021 South Carolina Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator.

The federal estate tax exemption for 2022 is 1206 million. For the 2021 tax year South Carolinas credit is worth 8333 of the federal earned income credit. Applications seeking the 6.

The South Carolina capital gains rate is 7 of the gain on the money collected at closing. Upon the wifes death she can use not only her own 5340000 estate tax exemption but also her husbands remaining 4340000 exemption.

What Is A Homestead Tax Exemption Smartasset

Homestead Property Tax Watercraft Greater Hilton Head Island Real Estate Re Max Island Realty

Blog The Autonomy Group Legacy Planning Pc Law Firm Rock Hill Sc Elder Law Estate Planning Special Needs Attorney The Autonomy Group Pc

North Carolina Income Tax Calculator Smartasset

Estate Tax Increase Looms Amid Shortage Of Qualified Lawyers Daily Business Review

How Every State Taxes Differently In Retirement Cardinal Guide

Tax News Views Minimum And Bachelor Tax Roundup

2022 State Tax Reform State Tax Relief Tax Foundation

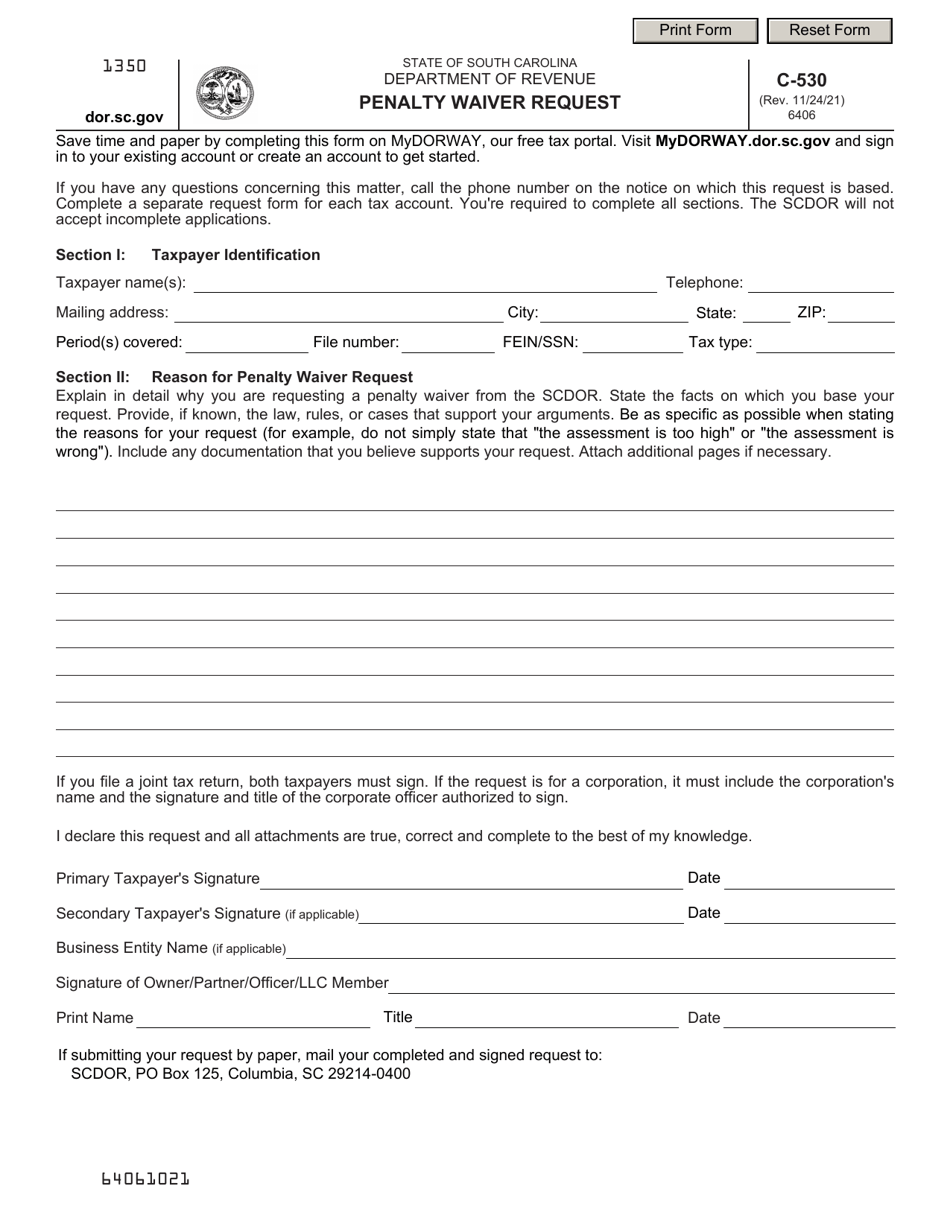

Form C 530 Download Fillable Pdf Or Fill Online Penalty Waiver Request South Carolina Templateroller

South Carolina Retirement Taxes And Economic Factors To Consider

/PropertyTaxExemptions-5abfea720b6f4b048a2e654e286d7230.jpeg)

Property Tax Exemptions For Veterans

Business Personal Property General Information

Nelson Mullins South Carolina S Dead Man S Statute Explained

Tax Law Update October 2021 Wealth Management

What Is A Homestead Tax Exemption Smartasset

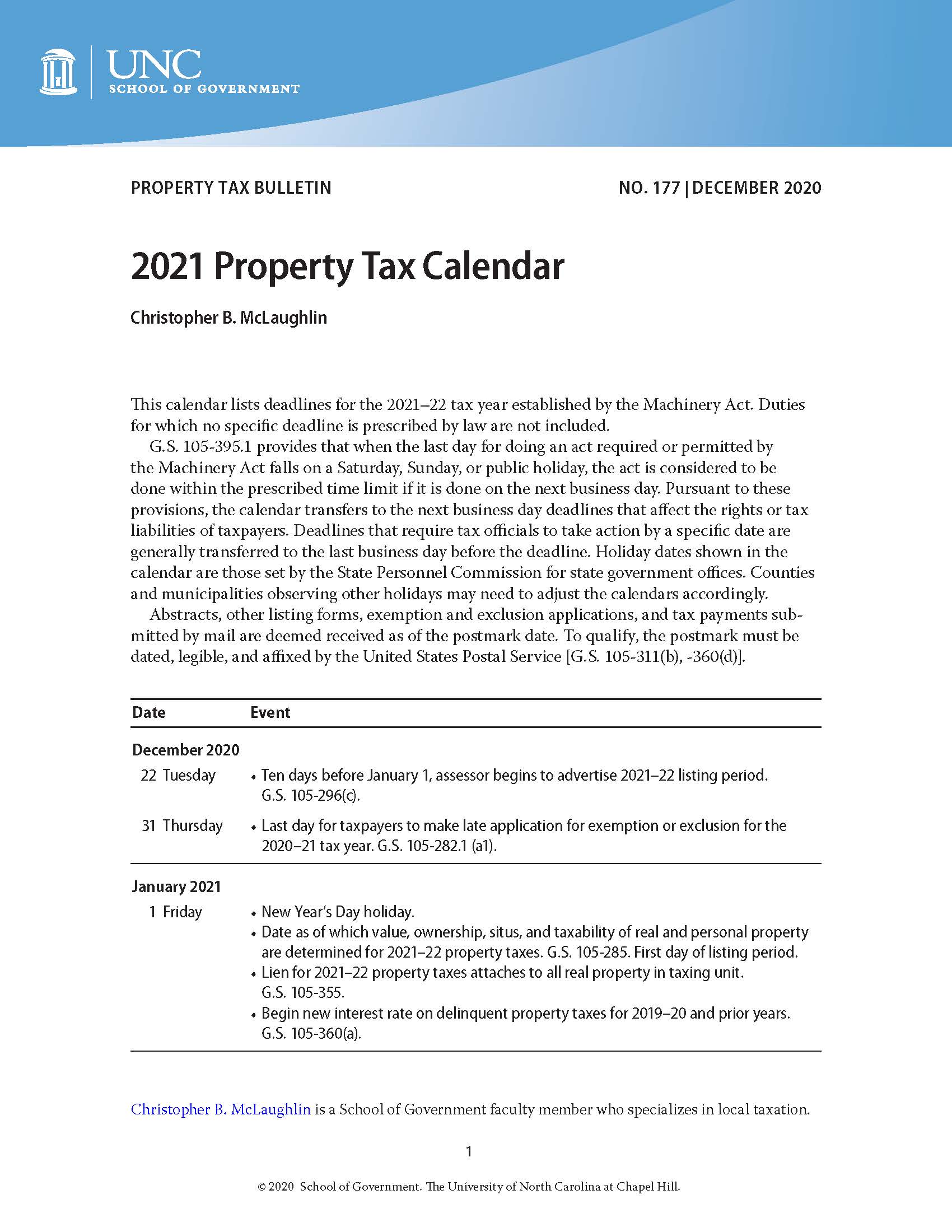

2021 Property Tax Calendar Unc School Of Government

Tax News Views Minimum And Bachelor Tax Roundup

Income Tax Increases In The President S American Families Plan Itep