sports betting in ct taxes

Gambling losses can be deducted up to the amount of gambling winnings. The Indiana sports betting tax rate is 323 which is pretty reasonable when compared to the betting tax charged by some other states.

Ontario Sports Betting Tax What It Means For You

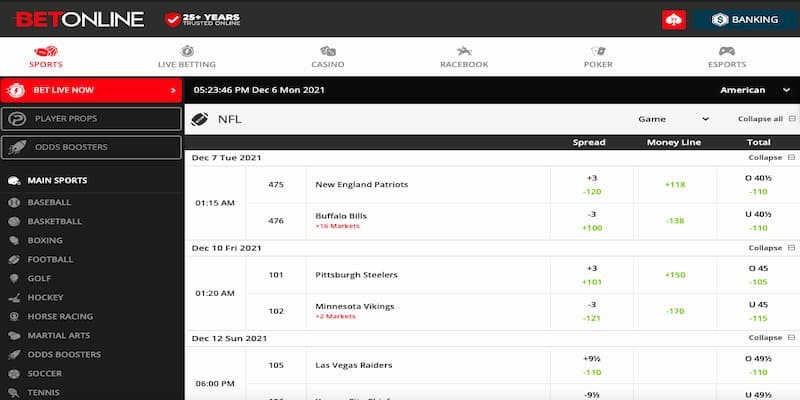

Sports betting taxes are almost always levied as a percentage of the value of the adjusted revenue revenue minus winnings.

. Those numbers will increase with. 0144 AM 6 October 2022. Whether gambling winnings are subject to Connecticut income tax depends on whether or not the winner is a Connecticut resident.

2 2021 219 pm. And 1375 on sports betting and fantasy sports. Online casino gaming and sports betting has been live in Connecticut since Oct.

The state taxes sports betting revenue each month from three master licensees. Proceeds will go to a college fund to allow students to attend. It is one of the few products where a price-based.

Sports betting is expected to bring in about 19 million in the first year and 23 million in tax revenue in the second year of the budget. Sports betting has been flourishing in Connecticut since governor Ned Lamont signed the legalization bill into law in May 2021. Many states including those that border Connecticut have already legalized or are currently considering legislation to legalize Sports Betting.

How to Bet on Sports in Connecticut Once both parties accept a wager it will not be altered or voided prior to the start of the event or championship. Winning tickets are void after one year. Sportech is a qualified partner to the State of.

Fortunately you can deduct losses from your gambling only if you itemize your deductions. The tax rate sits at 18 for bets placed online and 1375 for bets placed in-person. Latest Connecticut Sports Betting News By August 2022 the states three online sportsbooks and retail betting through the CT Lottery contributed to 859094 in taxes that were paid from 76.

Whether gambling winnings are subject to Connecticut income tax depends on whether or not the winner is a Connecticut resident resident. While the bill legalized sports betting it had no language that made for a regulated sports betting market that Connecticut lawmakers could tax. This rate applies equally to both the.

You need to know the following about virtual betting. Legislation Lamont signed into law in May 2021 sets an 18 percent tax for the first five years on new online commercial casino gaming or iGaming offerings followed by a 20. About making an online forecast in best sports bet apps.

Sports betting tax rate. Tax payments from sports betting operators in February were the lowest yet. 19 and the state reported.

If the winner is a resident of Connecticut and. It is projected to. All counties in Indiana also levy a.

The state will collect taxes of 18 initially on online casino gambling increasing to 20 after five years. You will have to form a coupon yourself - a beginner can cope with this task. Connecticut will impose a fixed tax rate of 1375 of gross sports betting revenue putting it in the middle of the range among US states with legal wagering.

If you receive cash from a sports betting facility you will receive a total that already has taxes taken out of it. Facilities are required to withhold 24 of your earnings for. Since PASPA was repealed by the Supreme.

If the winner is a resident of Connecticut and meets the gross.

Online Sports Betting Taxes How To Pay Taxes On Sports Betting

What S So Hard About Being A Us Sports Betting Startup In 2020

Connecticut Gives The Ok For Sports Wagering And Online Gambling

Peru Approves Law Regulating Sports Betting And Online Gaming Sets Net Win Tax At 12 Yogonet International

Sports Betting Might Come To A State Near You Tax Foundation

Online Sports Betting Is Live In Connecticut Ctinsider

Connecticut Gambling Revenue Highs And Lows In February

Missouri Sports Betting Bills Cleared For Senate Full Floor Debate Tax Rate Still An Issue Yogonet International

Opinion Sports Gambling Is Another Tax On The Poor And Minorities

Connecticut Governor Urges Approval Of Recreational Marijuana Sports Betting The Boston Globe

Ct Sports Betting Playsugarhouse Sportsbook Connecticut

Do You Have To Pay Sports Betting Taxes Smartasset

Connecticut Sports Betting Operators Beat Out Their Bettors In August

Connecticut Sports Betting Is It Legal Best Ct Betting Sites 2022

Best Connecticut Sports Betting Apps Bonuses October 2022

Connecticut Sports Betting And Online Sports Gambling Take A Step Forward

How Much Tax Casinos Pay Top 10 Highest Lowest Countries

Sports Betting Tax 2022 Do You Pay Tax On Sports Betting Winnings

Ct Collects Nearly 2 Million In First Month Of Online Gaming And Sports Betting Nbc Connecticut